/

The best trades require research, then commitment.

$0 forever, no credit card needed

Alex Honnold, free climber

Photo: Jimmy Chin ©

Where the world does markets

Join 100 million traders and investors taking the future into their own hands.

Love in every #TradingView

100M+

Traders and investors use our platform.

#1

Top website in the world when it comes to all things investing.

1.5M+

Mobile reviews with 4.9 average rating. No other fintech apps are more loved.

Netflix Pops as Earnings Top Estimates. Are Tariffs a Threat?Netflix NASDAQ:NFLX dropped its first-quarter earnings Thursday after market close and the headlines practically wrote themselves: a record net income, an earnings beat, and a 3% implied jump for the stock at the opening bell. All in a market where the Nasdaq is crying in the corner.

But as alwa

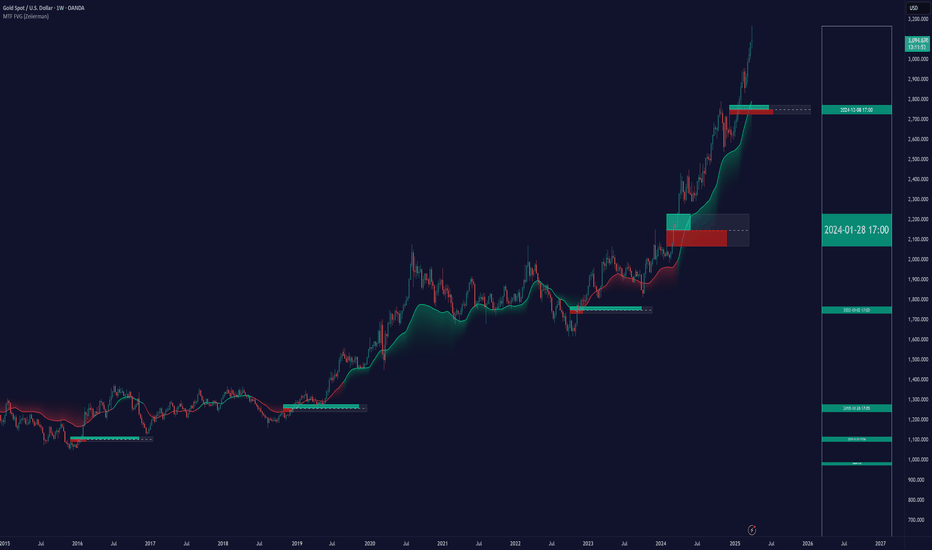

Gold - 7000 USD by 2027 (must see, sell here!)Gold is extremely bullish, but nothing lasts forever. To trade gold profitably, you need to always trade with a trend. Clearly the trend is bullish, so we want to open only long positions and avoid short positions to increase the probability of success, and it doesn't matter if you are an intraday o

S&P 500 - Key Levels and April 7-11 Weekly Candle StructureApril 7-11 will easily be remembered in 2025 as one of the craziest weeks in modern history.

Intraday swings were face ripping all from a Monday "fake news" becoming Wednesday "real news" with the US pausing tariffs for 90 days

5500 major resistance on S&P

4800 major support on S&P

I believe the

XAUUSD is in buy zone!After a short break on daily timeframe XAUUSD managed to breakout in the major direction of the trend with strong momentum with multiple liquidity grab from the support level. 5min shows a break of structure and drop to 3254.00 followed by strong rejection to the upside showing a high probability of

GOLD Trending Higher - Can buyers push toward 3,300$?OANDA:XAUUSD is trading within a well-defined ascending channel, with price action consistently respecting both the upper and lower boundaries. The recent bullish momentum indicates that buyers are in control, suggesting a potential continuation.

The price has recently broken above a key resistanc

How low Can the Dollar Go? And What It Could Mean for EUR/USDThe US dollar index has handed back all of its Q4 gains with traders betting that Trump's trade war will do more damage than good to the US economy. I update my levels on the US dollar index and EUR/USD charts then wrap up market exposure to USD index futures.

Crypto update 2025.04.14The current market moves due to tariffs are pushing away the interest from cryptos, as those are stuck somewhere between potentially being a safe-haven and still classed as a risky asset.

Let's dig in.

CRYPTO:BTCUSD

CRYPTO:BCHUSD

CRYPTO:ETHUSD

CRYPTO:LTCUSD

Let us know what you th

Tokenized AI-Agent. History and evolutionTokenized AI agents: a new foundation or a pretty wrapper?

If you spend at least some time on crypto Twitter or went to one of the fall crypto conferences, or even more so if you trade on on-chain, you can't have failed to hear about AI agents and the tokens around them. You're probably wondering wh

Ethereum Hits Critical Resistance — Is a Drop to $1400 Next?Introduction

Ethereum has been in a sustained downtrend over the past weeks, struggling to gain any real bullish traction. After a sharp decline last Sunday, the market remains under pressure, and although we’ve seen short-term attempts to recover, the broader trend still points downward. Technical

GOLD Price Analysis: Key Insights for Next Week Trading DecisionIn this video, I break down the key forces pushing gold to record highs. Learn how factors such as US-China trade tensions, global inflation pressures, and geopolitical uncertainty—combined with a weakening US Dollar and safe-haven demand—are reshaping the gold market.

In this quick analysis, we co

See all editors' picks ideas

Machine Learning RSI ║ BullVisionOverview:

Introducing the Machine Learning RSI with KNN Adaptation – a cutting-edge momentum indicator that blends the classic Relative Strength Index (RSI) with machine learning principles. By leveraging K-Nearest Neighbors (KNN), this indicator aims at identifying historical patterns that resembl

Half Causal EstimatorOverview

The Half Causal Estimator is a specialized filtering method that provides responsive averages of market variables (volume, true range, or price change) with significantly reduced time delay compared to traditional moving averages. It employs a hybrid approach that leverages both historica

BIN Based Support and Resistance [SS]This indicator presents a version of an alternative way to determine support and resistance, using a method called "Bins".

Bins provide for a flexible and interesting way to determine support and resistance levels.

First off, let's discuss BINS:

Bins are ranges or containers into which your

Probability Grid [LuxAlgo]The Probability Grid tool allows traders to see the probability of where and when the next reversal would occur, it displays a 10x10 grid and/or dashboard with the probability of the next reversal occurring beyond each cell or within each cell.

🔶 USAGE

By default, the tool displays deciles

Correlation Heatmap█ OVERVIEW

This indicator creates a correlation matrix for a user-specified list of symbols based on their time-aligned weekly or monthly price returns. It calculates the Pearson correlation coefficient for each possible symbol pair, and it displays the results in a symmetric table with heatmap

Tetris with Auto-PlayThis indicator is implemented in Pine Script™ v6 and serves as a demonstration of TradingView's capabilities. The core concept is to simulate a classic Tetris game by creating a grid-based environment and managing game state entirely within Pine Script.

Key Technical Aspects:

Grid Representation:

Log Regression Oscillator Channel [BigBeluga]

This unique overlay tool blends logarithmic trend analysis with dynamic oscillator behavior. It projects RSI, MFI, or Stochastic lines directly into a log regression channel on the price chart — offering an intuitive way to detect overbought/oversold momentum within the broader price structure.

Multitimeframe Fair Value Gap – FVG (Zeiierman)█ Overview

The Multitimeframe Fair Value Gap – FVG (Zeiierman) indicator provides a dynamic and customizable visualization of institutional imbalances (Fair Value Gaps) across multiple timeframes. Built for traders who seek to analyze price inefficiencies, this tool helps highlight potential ent

Relative Crypto Dominance Polar Chart [LuxAlgo]The Relative Crypto Dominance Polar Chart tool allows traders to compare the relative dominance of up to ten different tickers in the form of a polar area chart, we define relative dominance as a combination between traded dollar volume and volatility, making it very easy to compare them at a glan

Multi-Anchored Linear Regression Channels [TANHEF]█ Overview:

The 'Multi-Anchored Linear Regression Channels ' plots multiple dynamic regression channels (or bands) with unique selectable calculation types for both regression and deviation. It leverages a variety of techniques, customizable anchor sources to determine regression lengths, and

See all indicators and strategies

Community trends

Netflix Pops as Earnings Top Estimates. Are Tariffs a Threat?Netflix NASDAQ:NFLX dropped its first-quarter earnings Thursday after market close and the headlines practically wrote themselves: a record net income, an earnings beat, and a 3% implied jump for the stock at the opening bell. All in a market where the Nasdaq is crying in the corner.

But as alwa

UnitedHealth (UNH) Share Price PlummetsUnitedHealth (UNH) Share Price Plummets

UnitedHealth shares crashed by nearly 23% yesterday after the healthcare giant reported weaker-than-expected Q1 2025 results:

→ Earnings per share: actual = $7.20, expected = $7.29

→ Revenue: actual = $109.5bn, expected = $111.5bn

Technical Analysis o

Tesla - This Is Actually Not Gambling!Tesla ( NASDAQ:TSLA ) still looks quite bullish:

Click chart above to see the detailed analysis👆🏻

Just a couple of weeks ago I published a bunch of analysis, explaining all the reasons for a potential -40% drop on Tesla. However on the higher timeframe, Tesla still looks quite strong and with

RCL Eiffel Tower CAUTION! UPDATERCL is in a very capital-heavy industry that is very economically sensitive.

I first published this Idea back on February 11, 2025. Since then, it has dropped over -40%.

Normally, I would say that from erections come corrections. However, this has the Eiffel Tower structure in place for a full-on

push pass 40 is coming, i can smell it.boost and follow for more 🔥 CELH has clearly been in a uptrend for months, I also noticed when spy tanks CELH does not pullback much. But when the market rallies CELH follows.

This shows clear strength and sign investors aren't scared, and expect much higher and soon! this continues to be one of my

Nvidia: Bullish Monday?A new week is about to get started and we would like to know if the NVIDIA Corporation (NVDA) chart supports a bullish Monday.

What is the chart saying on the daily timeframe?

The chart has many positive signals and support a strong week but...

Good Sunday my fellow Cryptocurrency trader, how ar

OGI TOP №1The best stock of the cannabis sector.

I haven't bought cannabis stocks in 8 years. Now on the back of the falling index you can see who is strong and who is weak. This company is outperforming all of them. 1200% upside potential.

The cannabis market in the U.S. is projected to grow significantly,

We potentially about to see a HUGE move on TSLAWe broke a SUPER LONG-TERM BEARISH TRENDLINE (blue) on the weekly timeframe.

+

We have been RANGING for quite some time...

+

TSLA has a personality of explosive, crazy moves

+

TSLA builds HUMAN ROBOTS... (SUPER HIGH VALUE in my opinion, the potential for this is astronomical)

What do we actually ne

See all stocks ideas

Apr 21

GNTYGuaranty Bancshares, Inc.

Actual

—

Estimate

0.71

USD

Apr 21

ISTRInvestar Holding Corporation

Actual

—

Estimate

0.43

USD

Apr 21

PSTVPLUS THERAPEUTICS, Inc.

Actual

—

Estimate

−0.25

USD

Apr 21

HNVRHanover Bancorp, Inc.

Actual

—

Estimate

0.48

USD

Apr 21

RMBIRichmond Mutual Bancorporation, Inc.

Actual

—

Estimate

—

Apr 21

SRCE1st Source Corporation

Actual

—

Estimate

1.37

USD

Apr 21

ESCAEscalade, Incorporated

Actual

—

Estimate

0.13

USD

Apr 21

FVCBFVCBankcorp, Inc.

Actual

—

Estimate

0.24

USD

See more events

Community trends

Bitcoin - Who Will Take Control: Bulls or Bears?Bitcoin is currently exhibiting a prolonged phase of sideways movement, trading within a clearly defined consolidation range. After a sharp move to the upside earlier this month, price has stalled and started to range between the resistance zone near $86,000 and support around $82,000. This type of

BITCOIN's secret catalyst. The Gold-to-Crypto Rotation Is ComingBitcoin (BTCUSD) is attempting to form a new medium-term bottom here, following the Tariffs-led sell-off of the past 2 months. While the crypto market is consolidating and accumulating, the Gold market is smashing every historic All Time High (ATH) after the other.

This is not the first time we see

BITCOIN - Price can little correct and then make impulse upHi guys, this is my overview for BTCUSDT, feel free to check it and write your feedback in comments👊

Recently price broke through the $79500 zone after a long phase of flat consolidation and sharp shakeout.

Once bulls reclaimed control, price formed a clean breakout and started building structure

HelenP. I Bitcoin will drop, thereby breaking trend lineHi folks today I'm prepared for you Bitcoin analytics. Recently, price has been trading in a narrowing structure, forming a triangle pattern with a strong ascending trend line acting as support. This bullish line began developing after the price reversed from the 78500 - 79000 support zone, where bu

Bitcoin & ... Top Altcoins Choice— Your Pick (Session 2—2025)Bitcoin continues to do great and today moved for the first time above $86,000 after the 7-April 2025 market correction bottom and low. This is the lowest price before the 2025 bull market bullish cycle, phase and wave.

The 2025/26 bull market will be an extended bull market. The next All-Time High

TradeCityPro | Bitcoin Daily Analysis #65👋 Welcome to TradeCity Pro!

Let’s move on to the analysis of Bitcoin and key crypto indicators. In this analysis, as usual, I want to review the New York futures session triggers for you.

🔄 Yesterday, the market was range-bound again, and none of my triggers were activated. Today, a high has formed

BTCUSD: 4H Golden Cross to skyrocket it to $100kBitcoin has stabilized from the strong correction earlier in the month and that is reflected on its neutral 1D technical outlook (RSI = 53.619, MACD = 70.800, ADX = 32.691). This suggests that the market has priced a bottom and since it already broke over the LH trendline, the 4H Golden Cross that w

We are not early… we are right on time.📊 Overview:

The chart above shows what I believe is a nearly textbook Wyckoff Accumulation pattern, and we are currently transitioning out of the Spring and Test phase. The price action is aligning closely with the Wyckoff schematic overlayed in the lower quadrant of the chart — a clear signal that

Lingrid | TONUSDT Signs of REVERSAL at KEY Demand Zone OKX:TONUSDT market continues to consolidate after the sell off in the market. However, the market currently sits at the demand zone and it's giving signs of potential reversal. The price is in the accumulation phase around the 3.00 level. The price has decelerated at this zone followed by bullish d

See all crypto ideas

GOLD Bullish Continuation - Is $3,600 the Next Stop?OANDA:XAUUSD is trading within a well-defined ascending channel, signaling strong bullish momentum. The price has consistently respected the channel boundaries, forming higher highs and higher lows, which aligns with the continuation of the uptrend.

It has recently broken above a key resistance zo

OIL – Bearish Setup at FVG + Golden Pocket ConfluenceThis 4H chart of Crude Oil Futures highlights a clean bearish setup forming as price approaches a confluence zone of imbalance and premium pricing. After a sharp downward move, the current rally appears to be a retracement into areas of interest for potential distribution.

---

1. Context & Market

GOLD → Recovery after the FB of 0.5 fibo. What's next?FX:XAUUSD on Thursday tests 0.5 fibo, which I outlined to you on April 17, forms a false breakdown and recovers amid unstable geopolitical relations in the world. Price may continue its northward run.

The dollar continues to fall. The fundamental background depends on the relationship between

Lingrid | GOLD potential Trend Continuation FormationsOANDA:XAUUSD market pulled back as expected and retested 50% of the previous daily range. The market is forming bullish flag pattern or triangle pattern which are both trend continuation formations. If the price breaks above, it may trigger more upward pressure pushing price toward the channel bord

Hellena | Oil (4H): SHORT to support area of 55.204.Colleagues, I believe that the price will continue its downward movement. At the moment we are observing a combined correction. I expect the completion of wave “Y”. Even if it is already completed, the price is still waiting for a downward correction to the support area of 55.204. Therefore, I think

Gold can exit from wedge and drop to support levelHello traders, I want share with you my opinion about Gold. Price action on Gold has shown strong bullish momentum earlier, as it broke out of the previous upward channel and started forming an upward wedge. The rally gained traction once the price left the buyer zone between 3006 - 3025 points, pus

GOLD (XAUUSD): Trend-Following Setup ExplainedI spotted a bullish flag pattern on ⚠️Gold pair.

After reaching a new higher high, the price corrected within an expanding channel

To catch the next bullish move, I'm waiting for a bullish breakout of the flag's resistance.

We need a 4H candle close above that to confirm the breakout.

Target will

Gold - 7000 USD by 2027 (must see, sell here!)Gold is extremely bullish, but nothing lasts forever. To trade gold profitably, you need to always trade with a trend. Clearly the trend is bullish, so we want to open only long positions and avoid short positions to increase the probability of success, and it doesn't matter if you are an intraday o

The Secret Behind Stop-Loss Sweeps & How to Escape the Psycholog“You’re not losing trades because you’re unlucky…

You’re losing because someone out there is smarter — and they're hunting your stop.”

It’s time you see the real game behind every wick, fakeout, and reversal.

This isn’t guesswork. It’s called Liquidity Hunting — and it’s how institutions profit off

GOLD - After upward movement, price can correct to support areaHi guys, this is my overview for XAUUSD, feel free to check it and write your feedback in comments👊

After a long, steady climb inside a rising channel, Gold pushed through local resistance and gained momentum.

The move extended beyond the channel's top, marking a fresh high near $3240 points, attr

See all futures ideas

EURUSD - at Resistance: Will it drop to 1.11300?OANDA:EURUSD price is now at a strong resistance level, this is an area where it has struggled to break through in the past and reversed to the downside. It's also where sellers have stepped in before, so it’s worth keeping an eye on, especially for anyone considering short trades.

If we start see

USDCHF Discretionary Analysis: Bounce at 0.85Hello traders.

I'm anticipating the momentum on USDCHF to carry on. Got my eyes locked on the 0.85 area. It might turn into a strong bounce point. If the signs are there, I'm jumping in with a short.

Discretionary Trading: Where Experience Becomes the Edge

Discretionary trading is all about making

Euro may correct to support area and then rebound upHello traders, I want share with you my opinion about Euro. Looking at the chart, we can see that the price started its growth from the buyer zone between 1.0730 - 1.0785 points, where the price found strong support near the lower boundary of the broadening wedge. After bouncing off that zone, Euro

HelenP. I Euro can make correction movement to $1.1150 pointsHi folks today I'm prepared for you Euro analytics. After testing the upper boundary of the ascending channel, the price showed signs of slowing momentum. Earlier, the price steadily climbed within the upward channel, forming consistently higher lows while bouncing from the lower trend line and supp

AUDUSD Potential UpsidesHey Traders, in today's trading session we are monitoring AUDUSD for a buying opportunity around 0.63600 zone, AUDUSD is trading in an uptrend and currently is in a correction phase in which it is approaching the trend at trend at 0.63600 support and resistance area.

Trade safe, Joe.

Could the price bounce from here?GBP/AUD is falling towards the pivot which is an overlap support and could bounce to the 1st resistance which acts as an overlap resistance.

Pivot: 2.0624

1st Support: 2.0413

1st Resistance: 2.1029

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should o

#GBPUSD: Massive Swing Sell Is In Making 1200+ Pips Worth? **FX:GBPUSD Price Analysis**

GBPUSD price has recently experienced an overbought condition, primarily due to the significant decline of the DXY index. This decline can be attributed to the ongoing trade dispute between China and the United States, which has resulted in a drop in the DXY index to its

USDJPY – Strong Bounce Incoming from Key Support?Price has tapped into a major support zone that’s held strong since early 2024. With confluence from the Fibonacci 0.618–0.65 retracement overhead, we could see a sharp bullish reversal targeting that region.

🟧 Strong support – historically reactive

📈 Potential bullish reversal in play

Lingrid | GBPJPY short-term BULLISH move from the SUPPORTThe price perfectly fulfilled my last idea . FX:GBPJPY price is making higher low and higher highs showing bullish trend on the 1H timeframe. The market seems to be moving sideways below the psychological level at 190.000, which means that the market may retest the zone above it because the price

See all forex ideas

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - |

Trade directly on the supercharts through our supported, fully-verified and user-reviewed brokers.